Indians account for 23 per cent of the world's total annual demand for gold. And now we have got one more way to invest in the yellow metal.

Benchmark Mutual Fund launched India's first gold Exchange-Traded Fund (ETF) on 15 February followed by UTI Mutual Fund's gold scheme on 1 March 2007. Others like Kotak Mutual Fund and Prudential ICICI Mutual Fund have also firmed up plans and are expected to follow suit.

Gold ETFs have been a much-anticipated development. These are expected to address issues of higher prices, purity, costs of insurance and storage, and liquidity associated with investing in physical gold. What does this mean for an investor? Should gold be included in his portfolio? What value will it add to his holding and overall investment strategy? These are questions that will determine whether gold ETFs will be as big a success in India as they have been in countries such as the US, the UK and Switzerland.

What are gold ETFs?

Gold ETFs are open-ended mutual fund schemes that will invest the money collected from investors in standard gold bullion (0.995 purity). The investor's holding will be denoted in units, which will be listed on a stock exchange.

These are passively managed funds and are designed to provide returns that would closely track the returns from physical gold in the spot market.

An investor can buy and redeem the units either directly from the mutual fund, subject to certain stipulations, or from the stock exchange.

For example, in Benchmark Mutual Fund's scheme, the units will be allotted in such a way that the value of each unit will correspond to one gram of gold. This means that if an investor invests Rs 10,000, when the price of 10 gm of gold is Rs 9,650, he will be allotted 10.20 units (Rs 10,000 - 1.5 per cent entry load / 965). Each unit will initially represent one gram of gold though this will come down gradually when gold is sold to meet fund expenses.

Benchmark Mutual Fund allows its investors to buy and redeem the units after the new fund offer, either directly from the fund (subject to certain stipulations), or from the stock exchange.

Benchmark Mutual Fund allows its investors to buy and redeem the units after the new fund offer, either directly from the fund (subject to certain stipulations), or from the stock exchange.

UTI Mutual Fund's scheme allows investors to redeem units only through authorised participants, or by selling in the secondary market. The price of the units in the secondary market will, to a great extent, reflect the price of one gram of gold.

Other funds such as Tata Mutual Fund expect to allot units at face value (Rs 10,000 - entry load/10). The net asset value (NAV) of these schemes would reflect the value of the underlying gold. The price of these units in the secondary market would reflect the NAV and the supply and demand of the units.

Benchmark and UTI will appoint market makers (authorised participants) who will buy and redeem gold units from the fund as well as in the secondary market. This is expected to keep the price of the units in the secondary market close to the fund's NAV and the spot price of gold.

Why choose Gold?

Gold holds its own in any investment evaluation on its strengths as a hedge against inflation, value in the event of political uncertainties and its traditionally negative co-relation with other asset classes such as stocks, fixed income securities and commodities.

The value of goods and services that gold can buy has remained stable unlike currencies that have seen significant fluctuation. A study spanning a 400-year period has shown that the basket of goods and services that gold could buy over the period has remained the same.

Gold protects your portfolio from volatility because the factors, both at the macro-economic and micro-economic fronts that affect the returns from most asset classes do not significantly influence the price of gold. Just after 9/11, while stockmarkets and bonds crashed across the world, gold held steady and, in fact, rose on that day by six per cent.

For a given level of returns from a portfolio, the risk or volatility can be reduced by adding gold to it. Similarly, crises such as wars, which have a negative impact on prices of most asset classes, have a positive impact on gold prices since the demand for gold goes up as a safe haven for parking funds. It is the only medium of exchange completely free of credit risk as it does not imply a liability for any other entity.

What returns can you expect?

The 35 per cent return that gold has delivered in the last one year and 170 per cent absolute return in the last five years is not par for the course. In the period 1970-1982, gold prices had a compounded annual growth rate (CAGR) of around 21 per cent while inflation grew by 14.1 per cent over the same period. But in the following 23 years, inflation grew by 7.6 per cent while gold prices grew by 7.78 per cent.

Over the long term the realistic returns from gold would just beat inflation. Factor in entry loads (a high 2.5 per cent for UTI-Gold) and annual fund management costs of 1 per cent or more, and the returns are not appealing, though the costs are expected to come down in the long run.

However, in the short and medium term investment in gold can be very rewarding considering that the prices have come off the highs quite a bit and the indicators all point to a revival in the price rally.

Further, global demand for gold is 1,000 tonnes more than supply. With no new mining capacity coming through, most of the gold is being recycled. Inflationary pressures in the world economy are positive drivers of gold prices. The central banks of Russia, China and West Asian countries are giving strong buying support to gold prices.

Gold prices could also go up due to demand from gold ETFs, as they did in the London Stock Exchange in 2004. Investing in gold requires constant evaluation of international developments especially of crude oil prices, unfavourable geopolitical developments and the strength of the US dollar.

Gold ETFs are passively managed funds and, hence, not geared to exploit positive or negative trends. However, the investor can vary portfolio allocation to gold ETFs to take advantage of these trends.

Why gold ETFs?

There are enough reasons why gold should be included in any investor's portfolio whether in physical or paper form. Investing in gold ETFs will give the investor all the advantages of investing in gold while eliminating drawbacks of physical gold -- cost of storage, liquidity and purity, among others.

There are enough reasons why gold should be included in any investor's portfolio whether in physical or paper form. Investing in gold ETFs will give the investor all the advantages of investing in gold while eliminating drawbacks of physical gold -- cost of storage, liquidity and purity, among others.

Gold ETFs are transparent investment vehicles that will have to conform to rigid regulations on investment norms and valuations. This assures the quality of gold that the fund will invest in and transparency in calculation of NAVs and, consequently, the market price at which these units will trade.

Gold ETFs allow investment in gold in small denominations, which makes it easier for the retail investor to participate. On the secondary market, the minimum lot is one unit. This enables the investor to accumulate units over time and reap the benefits of rupee cost averaging. The units can be redeemed either from the fund directly or from the market.

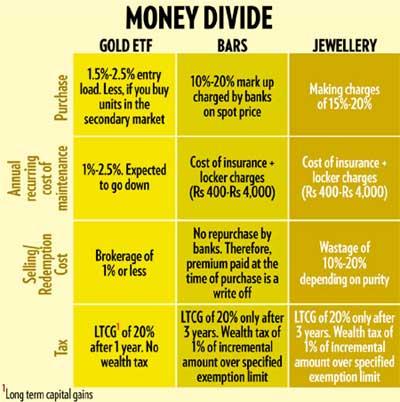

Further, investing in paper gold gives investors tax advantages over investing in physical gold. Gold ETF units held for more than one year qualify for long-term capital gains at 20 per cent, whereas the holding period in physical form has to be three years to qualify for long-term capital gains. For less than three years, the gains are taxed at 30 per cent. Also, gold held in paper form is not liable for wealth tax.

Should you invest?

Stability, reduced volatility in a well-diversified portfolio, inflation-plus returns, convenient investment vehicle to get tax-efficient exposure, are all good reasons to invest in gold ETFs. However, if you are looking to trade in the metal to take advantage of short-term price fluctuations then you are better off trading in futures on the commodities market. The fund management cost, however low, will reduce the returns. If you are looking for high long-term returns, then equity markets are a better option.

The launch of gold ETFs has widened the range of asset classes offered by mutual funds. These funds can definitely form five to 10 per cent of a portfolio as a form of insurance.

However, there are certain issues that investors must keep in mind while doing so. Liquidity may become an issue for small investors who want to exit, especially in times of crisis. Finding buyers at a fair price in the markets may become a problem if you need to convert to money.

Redeeming units directly from the fund may not be an option available. Again, during periods of financial crisis like hyperinflation or failure of banks, the large investors may convert paper holdings to physical gold. Small investors who do not have this option may be left holding illiquid paper. In such a situation, gold loses its edge as a store of value.

On the returns front, while gold ETFs can add lustre over smaller periods, the returns they generate in the long term are not very encouraging. Entry loads and fund management costs further reduce returns. You could consider buying the units in the secondary market, where brokerage costs may be lower than the applicable entry load.

If an investor is clear about the reasons for investing in gold and the issues related to it, there is every reason to include gold as an asset class in the portfolio and the gold ETF may be just the ideal vehicle to join in the gold rush.

'Gold's an all-season asset'

Sanjiv Shah, executive director, Benchmark Mutual Fund, the fund house that launched India's first gold exchange-traded fund (ETF), takes us through the nuances of the fund.

Why should one invest in a gold ETF?

There are many reasons. It is easier to hold gold and there is no wealth tax on paper gold as in the case of physical gold. Also, long-term capital gains at 20 per cent is applicable after just one year. You can also borrow from a bank against gold BeES (Benchmark Exchange Traded Scheme), also called GB, as it is legitimate collateral.

We believe that gold is a very good hedge against inflation, and given the geo-political risk globally, gold is a very good, all-seasons asset. The purchasing power of gold remains constant irrespective of the situation.

While gold ETFs' expense ratio will be akin to that of equity funds, their taxation status would be equivalent to debt funds. Isn't this a disparity?

Not really. Higher allowable expense ratio is irrelevant as gold ETFs will have a lower expense ratio, even lower than debt funds. By virtue of being an ETF is in itself an attempt to keep the expense even lower.

GB's expense ratio is capped at one per cent. Currently the custodian charges are high, but you can expect these to drop on the back of the growth in assets. Management fees are negligible. Our endeavour is to reduce our expenses.

How do investors buy Gold BeES? Investors in smaller towns don't seem to have access to as many brokers.

GBs will be listed on the National Stock Exchange (NSE). All you need to do is go to a broker, just like when you buy a share, and tell him you want to buy a GB. You need a demat account and a broker account. With a presence in 500 towns and 30,000 terminals across the country, NSE has the best network in India.

Can investors surrender their existing gold jewellry to you and in exchange for gold BeES units?

No, not yet. We don't have the infrastructure to be able to check the quality of gold that investors may want to surrender in lieu of gold BeES units. We would love to do it in future. At present, we are trying to work out a system where investors get physical gold when they redeem gold BeES.

How will you check the quality of the gold that your authorised participants (AP) will deposit with you?

The custodian will check the quality of gold surrendered. Besides, we are taking physical gold only from authorised participants with whom the custodian and we have a comfort level. And, unless the custodian certifies and confirms that the gold submitted by the AP matches their standards, we will not issue creation units. That keeps a check on quality.

Is your custodian completely responsible for the security of gold that forms the underlying asset of a gold BeES?

Bank of Nova Scotia, world's largest custodian of gold ETFs, is our custodian. They understand the gold market pretty well.

-- Kayezad E. Adajania, Outlook Money